Summer events for the tax industry are in full swing as professionals from around the country gather to share resources, insight, software, and tools for the 2024 filing season. The Drake Software team has enjoyed the time on the road and the opportunities to meet...

Summer events for the tax industry are in full swing as professionals from around the country gather to share resources, insight, software, and tools for the 2024 filing season. The Drake Software team has enjoyed the time on the road and the opportunities to meet...

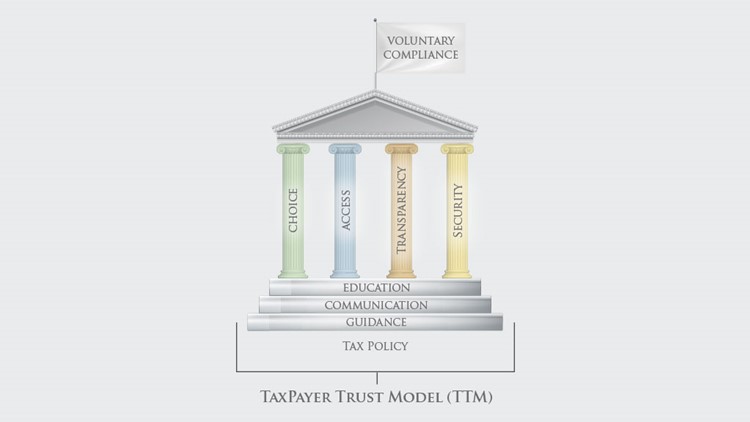

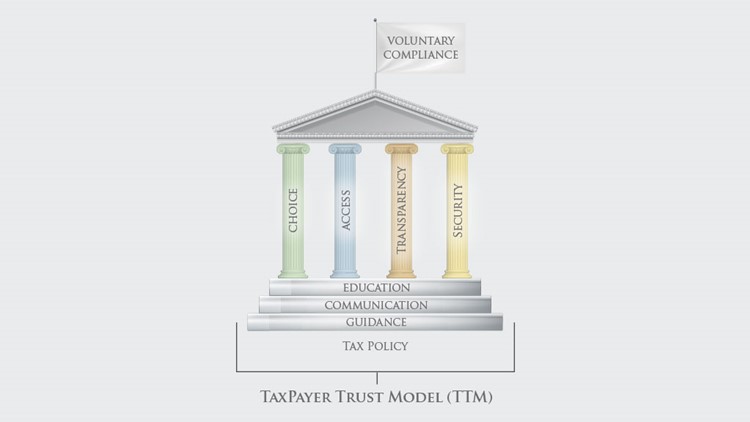

A key Internal Revenue Service advisory committee has issued its recommendations for 2023, in an effort to keep the IRS – and Congress – on point with improvements to the nation’s income tax filing system. The Electronic Tax Administration Advisory...

A key Internal Revenue Service advisory committee has issued its recommendations for 2023, in an effort to keep the IRS – and Congress – on point with improvements to the nation’s income tax filing system. The Electronic Tax Administration Advisory...

Weeks of record flooding and mountain snows brought on by an “atmospheric river” in California resulted in a federal disaster declaration from the Federal Emergency Management Agency (FEMA). While disaster victims received tax relief from filing and payment...

Weeks of record flooding and mountain snows brought on by an “atmospheric river” in California resulted in a federal disaster declaration from the Federal Emergency Management Agency (FEMA). While disaster victims received tax relief from filing and payment...

A new wave of advertising is churning up interest in a tax credit intended to help businesses and non-profits that tried to retain their employees during the COVID-19 pandemic. However, the ads on TV and radio, online, and even direct mail leave out a critical fact:...

A new wave of advertising is churning up interest in a tax credit intended to help businesses and non-profits that tried to retain their employees during the COVID-19 pandemic. However, the ads on TV and radio, online, and even direct mail leave out a critical fact:...

The Internal Revenue Service is moving ahead with a program that will offer taxpayers a new option for filing their 2023 returns next year. Dubbed “Direct File,” a scaled-down version of the full program will allow taxpayers to file online for free, using an IRS-run...

The Internal Revenue Service is moving ahead with a program that will offer taxpayers a new option for filing their 2023 returns next year. Dubbed “Direct File,” a scaled-down version of the full program will allow taxpayers to file online for free, using an IRS-run...